Total Investment After 6 Years

₹ 10,57,570

What is an SIP Calculator?

The SIP (Systematic Investment Plan) Calculator is a free online financial tool that helps you calculate your returns from Systematic Investment Plan (SIP) investments. In simple words, we can say that this tool helps you to compare the returns from various SIP investment strategies.

It is also known as a Mutual Fund SIP calculator, which helps you estimate the future value of your SIP investments. It calculates the value of your SIP investment on various parameters, including the investment amount (i.e., the regular SIP contributions), the investment duration, and the expected rate of return. By entering these details into the SIP calculators, you can get your estimate of investments that may grow over time. While the final maturity amount of your SIP investment may differ due to various external factors, you can get an approximate understanding of the expected returns.

However, this SIP calculator gives you a clear idea of the expected returns and commitment required, and you can differentiate and take right decision about which SIP strategy is most viable for you.

Table of Contents

How does SIP Calculator Work?

Our SIP calculator works on three main factors:

- SIP amount, i.e., amount of the initial investment (P)

- Duration, i.e., how long investment (n)

- Return rate, i.e., expected rate of return on the investment (r)

Once you enter these details into the SIP calculator, it calculates instantly and shows the result on the graph, like what is your investment amount and expected return at the end of a specific period of time. It also allows you to download the result in PDF format.

How to Use SIP Calculator?

Here are the steps to use the SIP calculator to calculate the Systematic Investment Plan returns on maturity:

- Step 1: Enter the SIP amount that you want to invest (in rupees)

- Step 2: Select the duration for which you want to invest (in years)

- Step 3: Select the expected rate of return (in percentage)

The calculation will happen instantly and give you the result:

- The total value of your investment after the duration.

- The total invested amount.

- The total estimated returns from the investment.

How Are SIP Investment Returns Calculated?

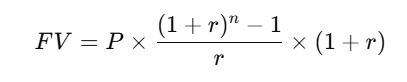

SIP (Systematic Investment Plan) returns are calculated using the Future Value (FV) formula for recurring investments. Since SIP involves monthly contributions, the compounding happens monthly, and the formula used is:

SIP Calculator Use This Future Value Formula

Where:

- FV = Future Value (total value at maturity)

- P = SIP amount per month

- r = Monthly interest rate (annual rate / 12 / 100)

- n = Total number of months (years × 12)

Let’s Understand SIP Calculation With an Example

Case:

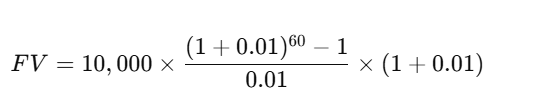

- SIP Amount = ₹10,000/month

- Duration = 5 years

- Expected Annual Return = 12%

Step-by-Step Calculation:

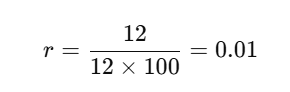

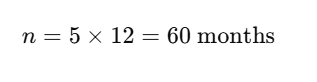

Step 1: Convert the annual rate to monthly

Step 2: Total investment period in months

Step 3: Put the value into the formula

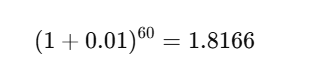

Step 4: Calculate the power term

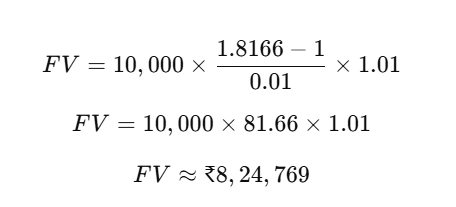

Step 5: Finally put everything into the formula

Summary of SIP Calculation Example

| Detail | Value |

|---|---|

| Monthly SIP | ₹10,000 |

| Total Months | 60 |

| Total Invested Amount | ₹6,00,000 |

| Future Value (at 12%) | ₹8,24,769 |

| Estimated Returns | ₹2,24,769 |

Use This Calculator Also: Profit Margin Calculator

Key Advantages of Using a SIP Calculator

Here are the key advantages of using our SIP calculator:

Instant & Accurate Estimations

- Our SIP calculator quickly calculates the future value of your monthly SIP investment.

- Give a clear idea about the wealth that you can accumulate based on amount, duration, and expected return.

Save Time on Manual Calculations

- It saves your time with complex calculations.

- Do not require a calculator or formula to calculate your monthly SIP investment.

- Helps you to avoid errors during manual calculations.

Helps with Long-Term Financial Planning

- Allows you to visualize your long-term goals (like retirement, education, home).

- You can adjust the SIP amount or duration to meet specific targets.

Goal-Based Investment Insights

- This SIP tool helps you in setting realistic financial goals.

- You can plan SIPs for short-, mid-, or long-term goals like Buying a car, dream vacation, retirement corpus, etc.

Makes Investing Easy for Beginners

- If you’re new to mutual funds, the SIP calculator provides a user-friendly interface to explore investment outcomes.

Download Features

- Our SIP calculators allow you to download PDF results, making it easy to share with financial advisors or save for records.

What is the Difference Between Your and Angel One SIP Calculator?

There are only minor differences between our SIP calculator and Angel One SIP calculator, and that is the presentation of total investment after some years. But, the result is the same for both SIP calculators. Both Angle One SIP Calculator and Baniya Mind SIP calculator work on the same formula.

Final Thought on SIP Calculator

The SIP calculator is a smart, free, online and essential tool for anyone planning systematic investments. It empowers you to invest wisely, set achievable financial goals, and understand the power of compounding over time.